Volatility has returned to global financial markets following the latest developments in the ongoing trade spat between the US and China. Last week, President Donald Trump announced plans to slap a 10 per cent tariff on the remaining $300 billion of Chinese imports that aren’t yet subject to punitive tariffs. China responded by allowing the renminbi to weaken past the psychologically important threshold of seven per US dollar. Trump, in turn, labelled China a currency manipulator, suggesting it was deliberately devaluing the renminbi.

Amid all this, markets have come under pressure after hitting historic highs in recent weeks. On Monday, US stocks recorded their biggest one-day decline so far this year. Volatility in equity markets rose to its highest levels since May and yields on US Treasuries plunged. The selloff continued Tuesday in Asia but moderated somewhat after China’s central bank signaled support for the currency by fixing the renminbi’s benchmark exchange rate back on the strong side of seven to the dollar.

Views from the investment desk

Luc Froehlich, Global Head of Investment Directing, Fixed Income, said the US Treasury’s latest comments on currency manipulation were “a step-up in rhetoric.”

“But the reality is that China might be already moving more decisively towards further monetary policy easing to counter growing pressure from the most recent tariffs, which are weighing on business sentiment, as well as from the constraints imposed on Chinese developers’ funding. Both these dynamics have been restraining the government’s ability to stimulate its economy.

The renminbi weakening is potentially a sign of the People’s Bank of China’s (PBoC) growing appetite for a broad-based easing, which could help Chinese bonds finally catch up with the rally among global peers.”

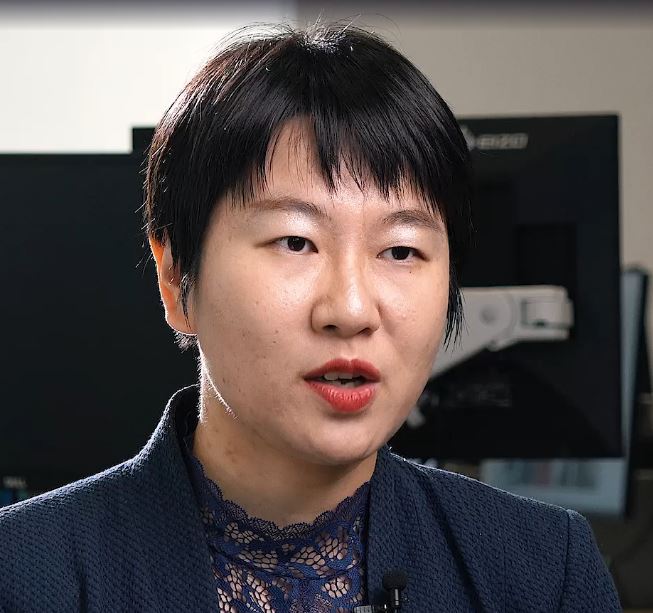

Lynda Zhou, Equity Portfolio Manager, said: “The renminbi ‘breaking 7’ itself is not a big surprise, given the deterioration in trade talks and the high likelihood of another round of tariffs in September. Also, the PBoC mentioned several times that the renminbi should have a wider trading range. However, the surprise to me is how bearish the market is on the renminbi. The US Treasury labeled China a currency manipulator, but the reality is very different. The renminbi ‘broke 7’ because China reduced intervention. When the offshore renminbi market moved down on Monday, the PBoC set the mid-point at 6.9225, only a 33 basis point depreciation compare to last Friday. Yet the market has been very bearish, quickly pushing it beyond 7.

Compared to other central banks, the PBoC has been hawkish amid the current global easing environment, thus we could have expected the renminbi to be resilient given the interest rate gap. The depreciation of the currency seems to reflect a bearish view on the global and Chinese economic outlook.

Fundamentally, a weak renminbi should be good for China’s companies as exports are still a big, albeit declining, part of the economy. With the exception of some airlines and Hong-Kong listed property developers, there are few US dollar loans held by Chinese companies, so from a foreign currency debt point-of-view, the risks of a currency mismatch on the balance sheet are very low.

However, a weaker Chinese currency could stem overseas expansion, which had heated up over the past year during the trade dispute, while the global capex cycle is also likely to decelerate if there is an impression of ‘currency wars’. Domestic equities could see some short-term selling pressure from foreign investors, as they consider US dollar-based returns as well as the fact that the renminbi is quite costly to hedge.”

George Efstathopoulos, Multi Asset Portfolio Manager, said: “With the US labelling China a currency manipulator, could the next step be a Trump attempt to push for US dollar intervention? Perhaps not a too distant scenario, given the way the US-China trade war has escalated in the past year.

President Trump has been very vocal in lamenting US dollar strength and its threat to his economic agenda. He’s failed to rule out currency intervention when asked directly and has a good track record of following through with his warnings. The chance of getting his way is surely higher now the Treasury have labelled China a currency manipulator and because the same department also has responsibility for setting US dollar policy.

This latest move at least levels the playing field somewhat and opens the door to a currency war, which would certainly up the ante in the trade war. However, it could prove counterproductive considering that in recent times, China has intervened to stop their currency from depreciating further rather than manipulating their currency weaker as accused by the US. China has used the ‘counter cyclical factor’ method for setting the value of the yuan, aiming to limit volatility rather than target a specific value. Should a currency war ensue, China might be less willing to prop up the renminbi.

While not my base case, the prospect of a US-China currency war is worrying and has risen in probability. I expect demand for safe havens to persist. Both the Japanese yen and gold should benefit if the situation escalates. More interestingly, the euro could be one of the biggest beneficiaries, bringing an end to 18 months of depreciation against the US dollar.”

Jing Ning, Equity Portfolio Manager, said: “It has always been my view that a worsening US-China relationship is the new norm for the medium term, a situation that is unlikely to be quickly resolved through negotiations. Prolonged tit-for-tat measures will continue to weigh on corporate sentiment towards future capex spending, while the planned next tariff hike on September 1st may start to dampen consumer demand, given higher import prices.

Key policy options for China to deal with trade uncertainty are to either boost domestic demand (especially in the property market) or use currency flexibility to help exporters mitigate the impact from the tariffs. This said, China has made it clear it won’t boost the domestic property market to stimulate the economy, which leaves currency flexibility as one of the few best options. Letting the renminbi break the psychologically important 7 per dollar barrier gives the People’s Bank of China more flexibility in the near-term.